The Next Cryptocurrency Startups

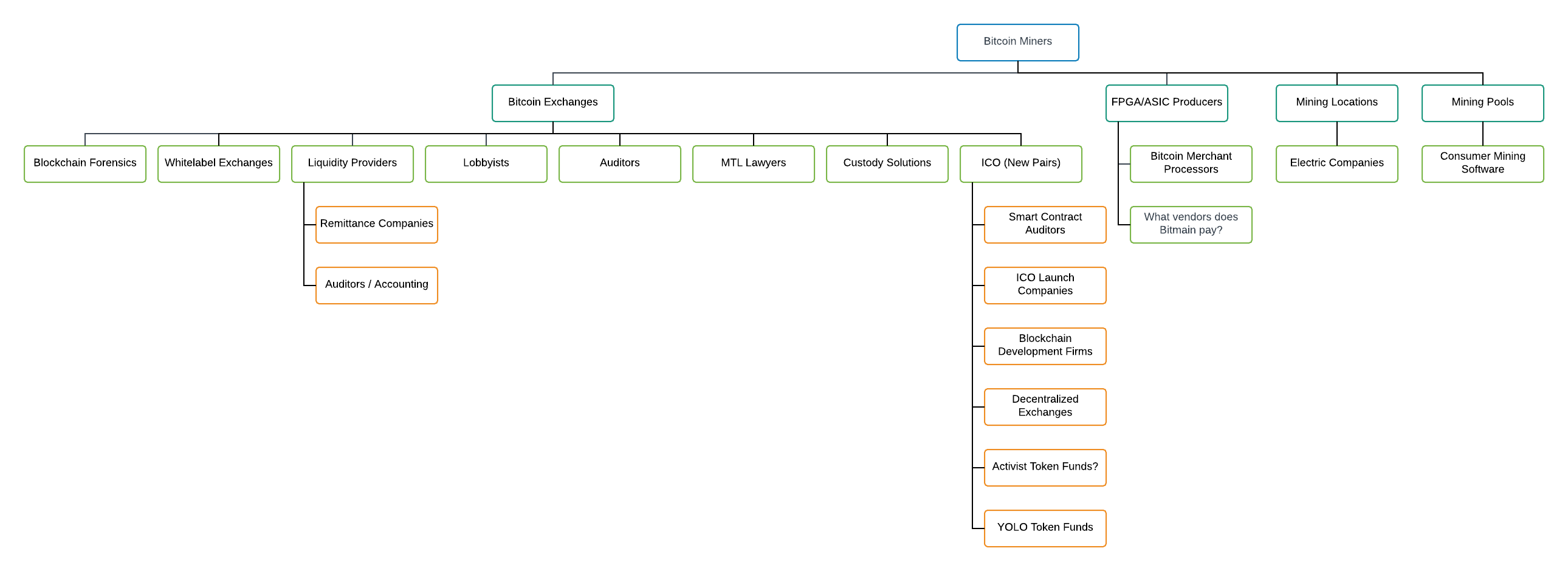

One way I've been thinking about the development of new infrastructure around digital currencies is by taking a look at the derivations of successful businesses that exist today in the industry. There are a lot of noisy startups in the space, but realistically only a select few are actually wildly successful. I think that essentially all of those companies can trace their success through this diagram I've created (click on the image to expand it).

Because of the economics of Bitcoin, you can trace where the money in the industry goes by looking at the industry with a miner-centric trickle down approach. Initially, the only successful business in cryptocurrency was a Bitcoin miner. In fact, if you believe the rumors of Satoshi's holdings, Bitcoin mining businesses are the first trillion dollar crypto-business. This was the tier one business.

The next tier down, you had the creation of services to service cryptocurrency miners. These were those selling the picks and shovels (fpga/asic manufacturers, locations with cheap electricity, mining pools) to the miners or buying the gold from them (Bitcoin exchanges and to an extent Bitcoin processors).

The next wave of businesses built (tier 3), were those to service those services built to serve miners. Bitcoin exchanges spawned a proliferation of vendors to help solve operational problems, including but not limited to liquidity, exchange software, custody, and interfacing with government. To a certain extent, ICOs and tokens became a vendor of exchanges, furthering the amount of pairs that could be listed. There are likely a lot of vendors that service Bitmain but I am not as familiar with the business so that aspect of my diagram is less filled out.

This leads to the the next stage, tier 4, which at this stage is mainly businesses that have been built off of ICOs and tokens. ICOs and tokens would not have been successful without the Bitcoin exchange infrastructure in place. I think this fourth stage is not fully developed yet, but these companies helped facilitate services for ICOs/smart contracts. While the flood of capital going into ICOs jumpstarted this tier it has not had a lot of time to become fleshed out, there is still plenty of room for services dedicated to supporting the still growing tier 3 businesses to prosper.

I think that the next successful startups will exist in the fourth tier of crypto-businesses. Additionally, many months or even years down the line, the fifth tier, those businesses servicing successful smart contract projects (like decentralized exchanges) will come into fruition and profitability. Investing in new companies that are competing with the now entrenched tier 1, 2 or even 3 businesses doesn't make much sense to me.

Let me know if you think this line of thinking makes sense to you, or if you can think of likely Bitmain vendors in the comments below.

Member discussion